Traveling abroad is an exciting and enriching experience that allows us to explore new cultures, cuisines, and landscapes. However, along with the excitement, international travel also comes with its share of risks, particularly related to health. Falling sick or getting injured in a foreign country can be a daunting and expensive ordeal. That’s where travel health insurance comes into play. Here’s why having travel health insurance is essential when traveling abroad.

Peace of Mind

Traveling should be a relaxing and enjoyable experience. Worrying about potential health issues can detract from the joy of your trip. Travel health insurance provides peace of mind by ensuring that you are covered in the event of a medical emergency. This allows you to focus on enjoying your travels without the constant worry of what might happen if you fall ill or have an accident.

Coverage for Medical Emergencies

Medical emergencies can happen anytime, anywhere. Whether it’s a sudden illness, an accident, or an unexpected health issue, being in a foreign country can complicate matters. With travel health insurance, you have access to medical care without the stress of hefty medical bills. Insurance companies often have networks of trusted healthcare providers worldwide, ensuring you receive quality care wherever you are.

Protection Against High Medical Costs

Healthcare costs can be extremely high in some countries, especially if you need hospitalization or specialized treatments. Travel health insurance covers these expenses, preventing you from paying out of pocket for potentially exorbitant medical bills. This financial protection is crucial, as unexpected medical expenses can quickly drain your travel budget or, worse, lead to debt.

Access to Quality Healthcare

In some regions, the quality of healthcare can vary significantly. Travel health insurance often includes access to high-quality medical facilities and professionals. Insurance providers can direct you to reputable hospitals and doctors, ensuring that you receive the best possible care. This access can be vital in a medical emergency, where time and quality of care are critical.

Coverage for Pre-Existing Conditions

Many travel health insurance policies offer coverage for pre-existing medical conditions, allowing travelers with ongoing health issues to receive necessary treatment while abroad. It’s important to disclose any pre-existing conditions when purchasing insurance to ensure you receive the appropriate coverage. This feature can be particularly beneficial for older travelers or those with chronic health conditions who may need regular medication or treatment.

Support and Assistance Services

Travel health insurance often includes additional services, such as emergency medical evacuation, translation assistance, and support for lost or stolen medication. In emergencies, these services can be invaluable, providing you with the support and resources you need to navigate a foreign healthcare system. Insurance providers often have 24/7 helplines to assist you with any questions or issues that may arise during your trip.

Protection Against Trip Cancellations

Travel health insurance can also offer trip cancellation coverage, reimbursing you for non-refundable travel expenses if you need to cancel or cut your trip short due to a medical emergency. This coverage can be crucial if unexpected health issues arise before or during your travels, allowing you to recoup some of the costs associated with your trip.

Storytime

Recently a client with a serious pre-existing condition fell ill and was rushed to one of the best hospitals in Barranquilla. He was admitted and spent about one week in the ICU. The client did not have a travel health insurance policy. Since the hospital was private, the wife had to pay about $10,000 USD in medical bills. The moral of the story is, please do not put your loved ones in a position where they may have to dip into their savings to pay for your medical expenses abroad. Obtain a travel insurance policy for peace of mind and unforeseen emergencies.

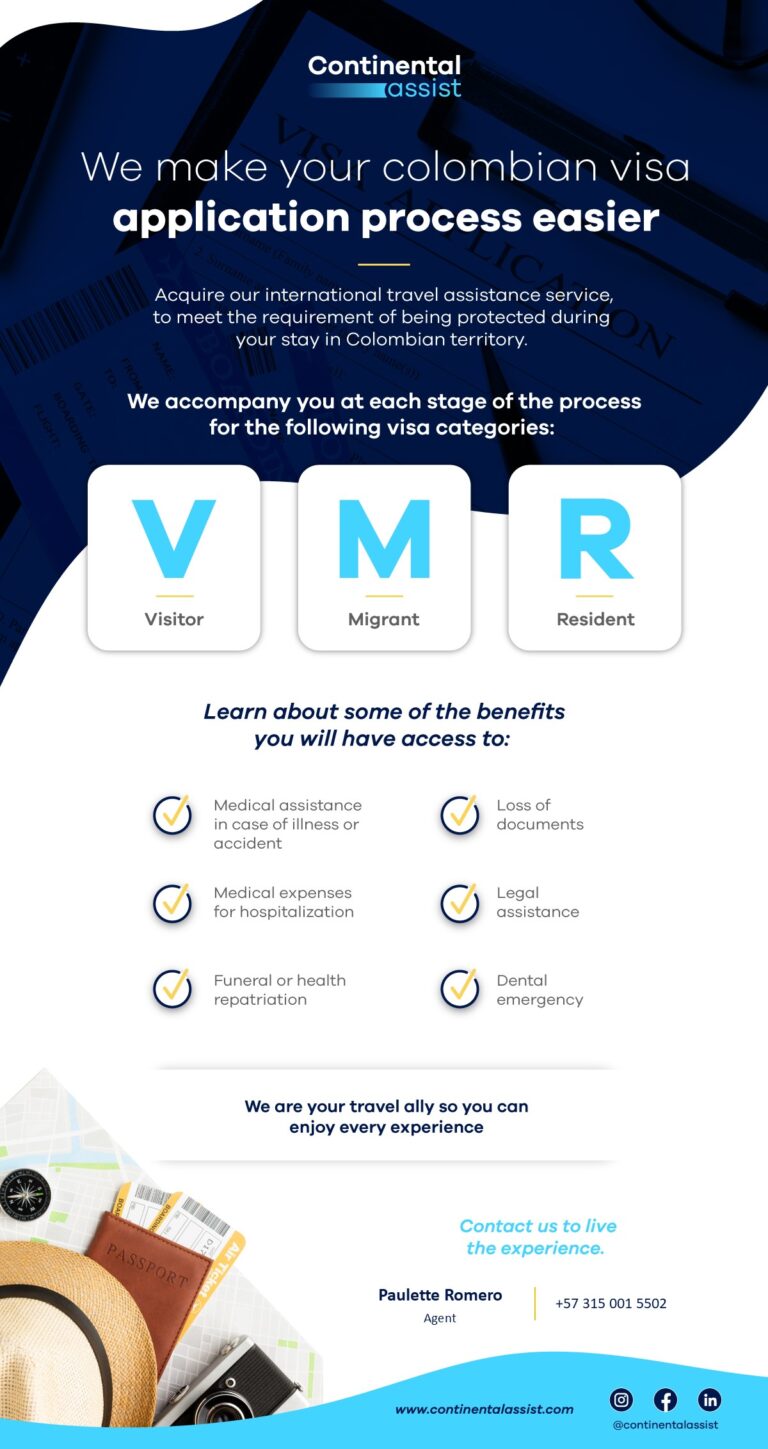

Continental Assist Insurance

Obtaining insurance with Continental Assist is a straightforward process that ensures peace of mind and comprehensive coverage. The company offers a range of insurance products, including travel, health, and student insurance, tailored to meet individual needs.

Continental Assist also offers insurance policies for persons seeking Colombian visas. Some visa types such as student and retirement visas request at least a one-year-long insurance policy to qualify for the visa.

To start, you can contact Erika R. from the customer service team at +57 324 496 3329 (Spanish only). She will guide you through selecting the right insurance plan. You can easily compare different policies, evaluate benefits, and choose the coverage that best suits your requirements.

Additionally, you can use this LINK to obtain a quote for yourself, or you can get in touch with Paulette Romero if you need assistance in English. Please use our contact form to contact Paulette.

Conclusion

Travel health insurance is an essential component of any international travel plan. It provides peace of mind, financial protection, and access to quality healthcare, ensuring you are prepared for any health-related challenges you may encounter while abroad. Investing in travel health insurance allows you to focus on the adventure and experiences of your travels, knowing you have a safety net in place. So, before you embark on your next journey, secure travel health insurance and travel confidently, knowing you’re covered no matter where your adventures take you.