A question we get asked often is from expats asking if their foreign pension is taxable in Colombia. The answer is: it depends on the total amount you receive on a monthly basis. The exclusion amount is relatively high so the vast majority of pensioners should not have to pay any taxes on their pension. Gerencie published an excellent article in Spanish which I have translated into English.

Taxpayers who receive a pension abroad can declare it as exempt income under the terms of section 5 of Article 84 of the tax statute.

Exemption on pensions earned and paid abroad.

Individuals who are tax residents in Colombia and collect a pension earned and paid abroad are entitled to the exemption provided in section 5 of Article 84 of the tax statute as per Tax Reform Law 2381 de 2024. Bear in mind, the new tax reform law goes into effect July 1, 2025.

Under the new legislation, the government treats Colombian-source and foreign-source pensions equally. As a result, all pensions, whether sourced from Colombia or abroad, are tax-free up to a yearly allowance of 1,000 UVT (UVT = unidad de valor tributario/taxable value unit). In 2024, 1 UVT equals COP $47,065, making the yearly tax-free amount COP $47,065,000 (approx USD $11,300 for 2024). The monthly tax fee amount averages out to about ~950 USD per month. If your yearly pension surpasses this amount (USD $11,300), taxes may have to be paid on the excess.

Note: The new legislation as per Tax Reform Law 2381 de 2024 is unclear and some experts say that the 1000 UVT amount is on a monthly basis while other experts say it’s applicable on a yearly basis.

This applies both to Colombians who have earned a pension abroad and are tax residents, as well as to foreigners who are tax residents in Colombia.

How to declare pensions paid abroad

Pensions paid abroad are declared under the pension section, as stated in Article 1.2.1.20.2 of Decree 1625 of 2016.

There is no general limit regarding the exemption on income in the pension section. The only limit being 12,000 UVT as established by section 5 of Article 206 of the tax statute.

Double taxation treaties on taxes paid on pensions abroad

The pension amount that exceeds 1,000 UVT per year is subject to income tax, meaning that income tax must be paid on the excess, and it is likely that tax was also paid in the country of origin on the same pension. In this case, double taxation treaties apply as per Article 1.2.1.20.2 of Decree 1625 of 2016:

“Pension income also includes income derived from pensions, retirement savings in life annuity systems, and similar income obtained abroad or from multilateral organizations. This is without prejudice to the provisions of the Treaties to Avoid Double Taxation signed by Colombia and in force.”

In general, under treaties to prevent double taxation, pension income is taxed in the country where the pension was earned and paid. In such cases, these incomes are taxed in that country and not in Colombia, and section 5 of Article 206 of the tax statute does not apply.

If no treaty to avoid double taxation exists with the country paying the pension, tax credits for taxes paid abroad may be applied. Therefore, if the individual must pay tax on those foreign pensions in their country of origin, they can deduct it in Colombia under the rules imposed by Article 254 of the tax statute.

Tax Treaties

A double taxation treaty (DTT), also known as a double tax agreement (DTA) or tax treaty, is an international agreement between two or more countries designed to avoid double taxation of income or capital. The primary goal is to prevent the same income from being taxed twice by different countries, which can hinder cross-border trade and investment.

Colombia has double tax treaties (DTTs) with the following countries:

- Bolivia

- Canada

- Chile

- Czech Republic

- Ecuador

- France (in force as of 2022)

- India

- Italy

- Japan (in force since 2023)

- Mexico

- Peru

- Portugal

- South Korea

- Spain

- Switzerland

- United Kingdom

Is an Expat’s foreign pension taxable in Colombia?

To summarize, if your foreign pension is less than ~$950 USD per month, it is not taxable. If your foreign pension is over ~$950 USD per month, it is likely taxable. Discover Barranquilla S.A.S. assumes no responsibility for the incorrect or late filing of tax returns. We recommend you speak to a tax professional to discuss your particular case. To read more about this exemption in Spanish, please click here.

Do I have to file a tax return during Colombian tax filing season?

To learn more about your obligations tin terms of filing a tax return during Colombian tax filing season, please read our 2025 Colombian tax filing season article. Tax filing season starts on August 12, 2025 and ends on October 24, 2025.

Can you put me in touch with a tax professional to assist me with filing my tax return?

Yes, please get in touch via our contact form or via Whatsapp and we would be happy to set up a 30-minute consultation with a Colombian tax expert. Alternatively, please review and purchase one of our Tax Return and Accounting Services below to get started or use our contact from for more information.

Can you help me process my retirement or pensioner visa?

Yes, we can assist you with processing your Colombian retirement visa. You can find additional information and our fees by clicking HERE. If you need insurance for your visa, we can also provide you with a quote.

RUT – Taxpayer ID Number Registration

A RUT, or Registro Unico Tributario, is the first document a taxpayer needs before they can file their taxes. You must request your taxpayer identification number from DIAN by registering for a RUT.

$200,000 COP ($50 USD)

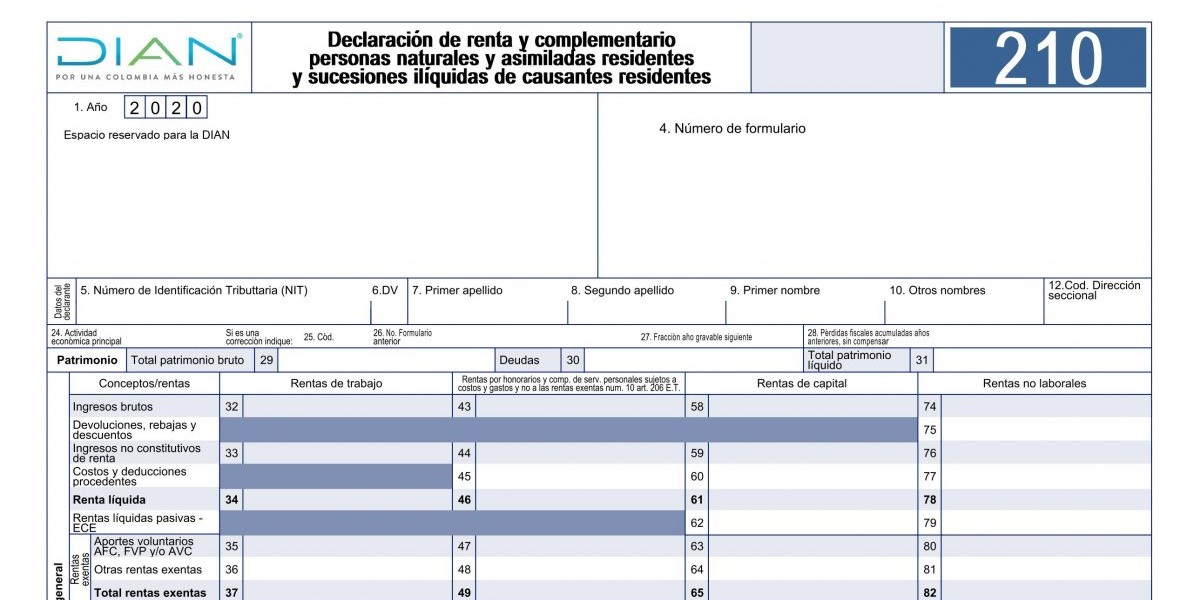

Form 210 – Tax Return for Natural Persons

Form 210 is the personal tax form that all natural persons in Colombia must file if the person meets the minimum income thresholds.

$375,000 COP ($100 USD)

Forms 210 and 160 – Tax Return for Natural Persons

If you have assets abroad, then along with filing form 210, you must also file form 160 to declare any assets you may have abroad valued over ~$23,000 USD.

One Comment