The 2025 Colombian tax filing season is upon us and the dates are approaching for individual persons to begin filing their income tax return with the Dirección de Impuestos y Aduanas Nacionales (DIAN – National Tax and Customs Directorate).

The tax calendar indicates that the first deadline for taxpayers in the country to file and make the corresponding payments (if any) for the tax filing period for year 2024, is August 12, 2025.

To avoid being caught off guard by this payment, consider some aspects that could help you fulfill this obligation.

Disclaimer: Discover Barranquilla S.A.S. takes no responsibility for the incorrect or late filing of tax returns. We recommend you seek the advice of a tax professional.

Do you offer tax filing services with a certified Colombian accountant?

Yes, you can view all the tax filing services we offer by visiting our Tax Return and Accounting Services page. We offer services for both personal tax return filings and business creation, filings, and other services.

Alternatively, please get in touch via our contact form or via Whatsapp and we would be happy to set up a 30-minute consultation with a Colombian tax expert.

If you’re ready to get started, you can also choose one of the services from the boxes below and make your payment.

RUT – Taxpayer ID Number Registration

A RUT, or Registro Unico Tributario, is the first document a taxpayer needs before they can file their taxes. You must request your taxpayer identification number from DIAN by registering for a RUT.

$200,000 COP ($50 USD)

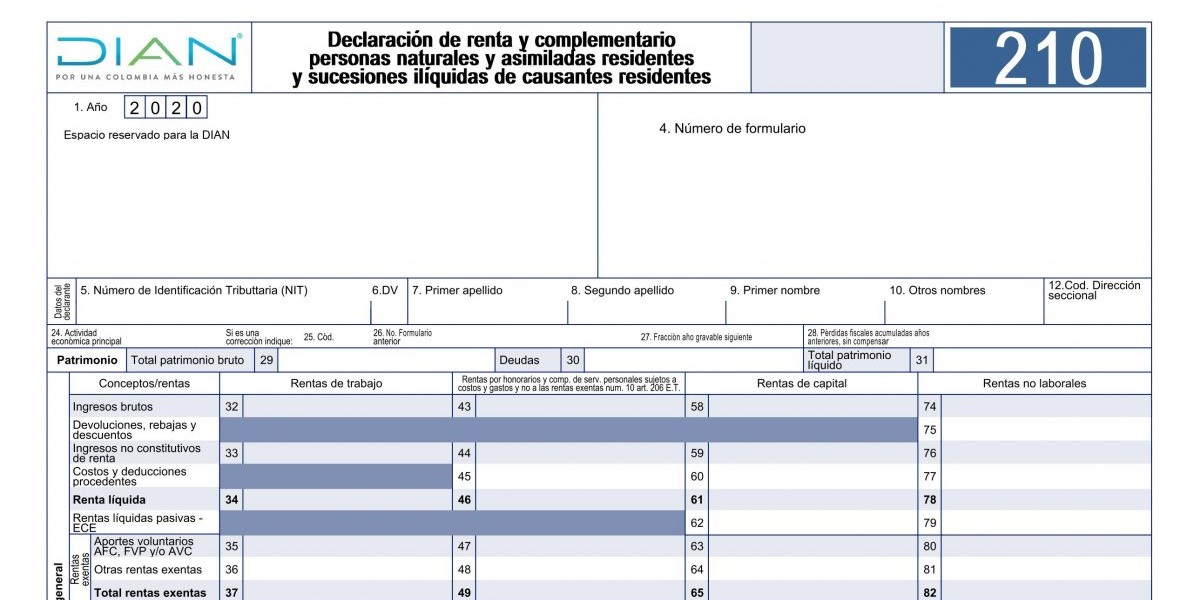

Form 210 – Tax Return for Natural Persons

Form 210 is the personal tax form that all natural persons in Colombia must file if the person meets the minimum income thresholds.

$375,000 COP ($92 USD)

Forms 210 and 160 – Tax Return for Natural Persons

If you have assets abroad, then along with filing form 210, you must also file form 160 to declare any assets you may have abroad valued over ~$23,000 USD.

$475,000 COP ($118 USD)

Who should file a tax return?

In order to determine if someone needs to file a tax return or not, some factors such as income, assets, purchases, salaries, and transfers from the previous year must be taken into account. DIAN establishes annual thresholds to determine who must fulfill this obligation.

You should speak with an accountant to see if you are required to file your taxes or not. The deadline to file your taxes depends on the last two digits of your cédula de ciudadanía if you’re Colombian. If you have a cedula de extranjería, it depends on the last two numbers of your NIT found in box 5 of your RUT. If you do not have a RUT (Registro Único Tributario), please speak with your accountant as soon as possible. You cannot file your 2024 tax return without this document. Filing late will result in a penalty of almost $500,000 COP.

Do I have to file a tax return if I receive a foreign pension?

Taxpayers who receive a pension abroad can declare it as exempt income under the terms of section 5 of Article 84 of the tax statute. Tax Reform Law 2381 de 2024 (which goes into effect July 1, 2025). Under this legislation, the government treats Colombian-source and foreign-source pensions equally. As per the Colombian government, the monthly tax-free amount equals approximately $950 USD. That means that if your foreign pension is less than ~$950 USD per month, then as per current legislation it is considered tax-free. In addition, if you’re from a country that has a tax treaty with Colombia, your entire pension may be tax-free. To read more about foreign pensions, please read our article: Is an Expat’s foreign pension taxable in Colombia?

Deduction for taxes paid abroad

Article 254 of the Colombian Tax Code, states that Colombian residents, as well as domestic companies and entities receiving income from foreign sources, can deduct from their Colombian income tax any taxes paid abroad, provided that the deduction does not exceed the amount of tax due in Colombia on the same income. This is true whether or not you are a citizen of a country with a tax treaty. For example, the Unites States does not have a tax treaty with Colombia, but if you paid taxes to the IRS then the amount paid counts as an eligible deduction on your Colombian tax return.

This tax credit aims to prevent double taxation, allowing taxpayers who paid taxes abroad to reduce their tax burden in Colombia. It is important to note that the deduction cannot exceed the tax liability in Colombia for the same income, and foreign income must be adjusted by imputing income, costs, and expenses.

To apply this deduction, taxpayers must provide valid evidence of the foreign tax payment, such as tax certificates issued by the relevant tax authority.

Tax Treaties

A double taxation treaty (DTT), also known as a double tax agreement (DTA) or tax treaty, is an international agreement between two or more countries designed to avoid double taxation of income or capital. The primary goal is to prevent the same income from being taxed twice by different countries, which can hinder cross-border trade and investment.

Colombia has double tax treaties (DTTs) with the following countries:

- Bolivia

- Canada

- Chile

- Czech Republic

- Ecuador

- France (in force as of 2022)

- India

- Italy

- Japan (in force since 2023)

- Mexico

- Peru

- Portugal

- South Korea

- Spain

- Switzerland

- United Kingdom

Which DIAN forms do I have to file?

At a minimum your accountant should be filing DIAN form 210 which is the tax form filed for all natural persons. According to DIAN, taxpayers who hold assets abroad must file form 160 which is the “Annual Foreign Asset Declaration”. This form must be filed on the same date as the income tax return. Foreign assets should be listed on this form. This can include things like real property, boats, cars, etc. This requirement applies if the total value of those assets exceeds 2,000 UVT, which is roughly $94 million COP (~$23,000 USD) in 2024.

Question 1: Are You a Tax Resident?

You are considered a tax resident if you have been in Colombia more than 183 days over a 365-day period. Keep in mind that this is NOT a calendar year analysis. You have to literally count the days you have been in Colombia over any 12-month period. If yes, you are technically a tax resident.

Question 2: I Am a Tax Resident. Do I Have to File?

In general, you will have to file a tax return for the 2025 Colombian tax filing season, if:

The value of your total assets exceeds COP $211,792,500 (this includes the value of your real estate, vehicles, etc); OR

Total annual income exceeds COP $65,891,000; OR

Total purchases via a credit card exceed COP $65,891,000; OR

Total purchases via any other method exceed COP $65,891,000; OR

Total banking activity (deposits, transfers, etc…)/financial investments exceed COP $65,891,000. This includes transfers to yourself from abroad.

What is the penalty for not filing or filing my income tax late?

Minimum penalty: In 2025, the minimum penalty for non-compliance or incorrect compliance with tax obligations is $498,000 COP. This means that if the taxpayer files one day after the established deadline, they will have to pay this amount, even if the taxpayer is not liable to pay any income tax.

Penalty for lateness: There is also a penalty for lateness, which amounts to 5% of the tax payable and increases for each month or fraction of a month that passes between the payment due date and the date the income tax return is filed.

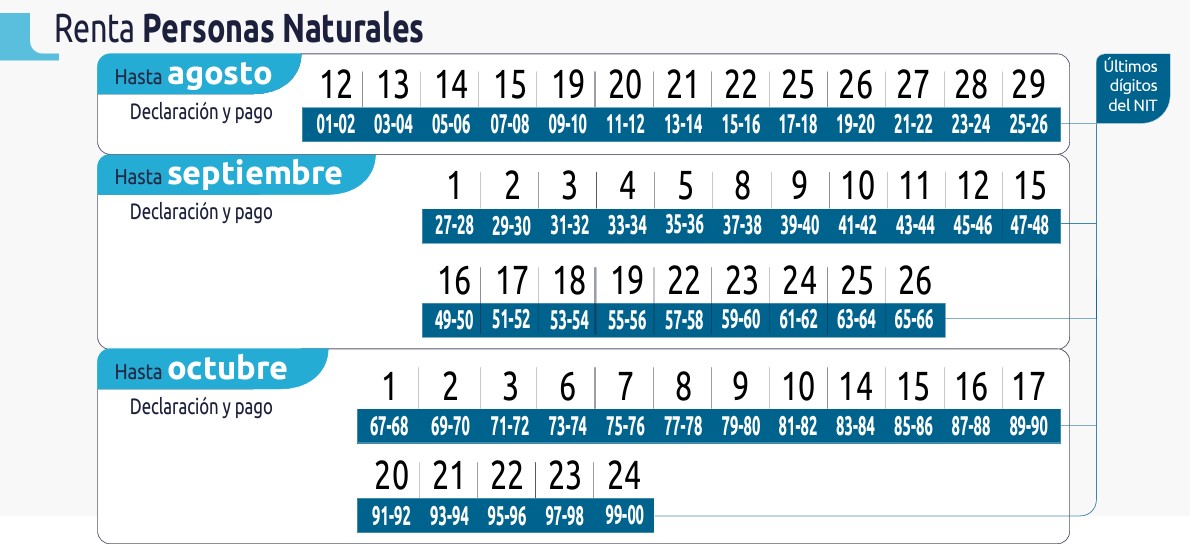

When is the deadline to file?

The deadlines for filing your income tax return for the 2025 Colombian tax filing season is determined based on the last two digits of your cédula de ciudadanía (if you are a Colombian citizen) or tax identification number (NIT) if you are a foreigner, which is assigned by the National Tax and Customs Directorate (DIAN) to identify taxpayers.

The established deadlines to fulfill this obligation start on August 12 and end on October 24, 2025.

The deadline is based on the last two digits of your NIT:

August deadlines

| 01 y 02 | August 12, 2025 |

| 03 y 04 | August 13, 2025 |

| 05 y 06 | August 14, 2025 |

| 07 y 08 | August 15, 2025 |

| 09 y 10 | August 16, 2025 |

| 11 y 12 | August 20, 2025 |

| 13 y 14 | August 21, 2025 |

| 15 y 16 | August 22, 2025 |

| 17 y 18 | August 23, 2025 |

| 19 y 20 | August 24, 2025 |

| 21 y 22 | August 27, 2025 |

| 23 y 24 | August 28, 2025 |

| 25 y 26 | August 29, 2025 |

September deadlines

| 27 y 28 | September 1, 2025 |

| 29 y 30 | September 2, 2025 |

| 31 y 32 | September 3, 2025 |

| 33 y 34 | September 4, 2025 |

| 35 y 36 | September 5, 2025 |

| 37 y 38 | September 8, 2025 |

| 39 y 40 | September 9, 2025 |

| 41 y 42 | September 10, 2025 |

| 43 y 44 | September 11, 2025 |

| 45 y 46 | September 12, 2025 |

| 47 y 48 | September 15, 2025 |

| 49 y 50 | September 16, 2025 |

| 51 y 52 | September 17, 2025 |

| 53 y 54 | September 18, 2025 |

| 55 y 56 | September 19, 2025 |

| 57 y 58 | September 22, 2025 |

| 59 y 60 | September 23, 2025 |

| 61 y 62 | September 24, 2025 |

| 63 y 64 | September 25, 2025 |

| 65 y 66 | September 26, 2025 |

October deadlines

| 67 y 68 | October 1, 2025 |

| 69 y 70 | October 2, 2025 |

| 71 y 72 | October 3, 2025 |

| 73 y 74 | October 6, 2025 |

| 75 y 76 | October 7, 2025 |

| 77 y 78 | October 8, 2025 |

| 79 y 80 | October 9, 2025 |

| 81 y 82 | October 10, 2025 |

| 83 y 84 | October 14, 2025 |

| 85 y 86 | October 15, 2025 |

| 87 y 88 | October 16, 2025 |

| 89 y 90 | October 17, 2025 |

| 91 y 92 | October 20, 2025 |

| 93 y 94 | October 21, 2025 |

| 95 y 96 | October 22, 2025 |

| 97 y 98 | October 23, 2025 |

| 99 y 00 | October 24, 2025 |

Did you file a tax return in 2024? You’ll notice that the minimum taxable amounts have risen and will rise every tax year.

Good luck with the 2025 Colombian tax filing season!

One Comment